Flexible retirement

Flexible retirement allows organisations and staff to be flexible about:

- the age at which staff retire

- the length of time staff take to retire

- the nature and pattern of work in the lead up to final retirement.

How flexible retirement supports staff retention

Flexible retirement helps employers to retain skilled staff by enabling those staff to work flexibly, with improved wellbeing and financial security.

Retirement flexibilities allow staff to access their pension benefits while remaining in, or returning to, the NHS workforce, with the option to build up further pension if they wish. This is a valuable part of the reward offer to attract and retain experienced staff who want to adjust their working pattern and manage their finances in the approach to retirement.

Staff can retire gradually and work flexibly for longer, passing their skills and knowledge to colleagues, aiding succession planning and ensuring high quality care for patients.

Working flexibly improves work life balance for staff, while accessing pension benefits supports financial wellbeing. This in turn can bolster staff health and wellbeing, reduce sickness absence and the risk of burn out, while strengthening retention and staffing levels over time.

Flexible retirement benefits for organisations

- Helps staff to continue working in the NHS for longer, by varying the nature or pattern of work in the lead-up to retirement.

- Increases the amount of staff available to cover high demand periods.

- Maintains continuity of high-quality care for patients and service users.

- Assists succession planning by retaining valuable skills and experience which can be passed on to other staff.

- Retaining valuable staff reduces the time and costs of recruitment and training.

- Supports staff financial wellbeing by allowing staff to claim some of their pension benefits and continue working in a more flexible way.

- Helps recruit staff who are attracted to the retirement flexibilities and the value of the competitive NHS Pension Scheme.

- Makes the NHS a great place to work by prioritising work life balance.

- Reduces staff absence by improving staff wellbeing.

Read the NHS Staff Council's guidance on the process for considering flexible retirement requests.

Flexible retirement options with employee scenarios

Employers should discuss the following retirement flexibilities with staff to reach an agreement about how they will be applied on an individual basis.

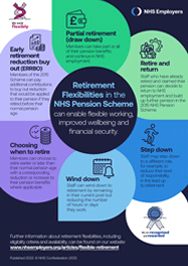

Partial retirement (draw down)

Retire and return

Step down

Wind down

Choosing when to retire

Each member has a normal pension age (NPA), at which they can retire and claim pension benefits without reduction. This age is defined by the scheme or section they are a member of.

The NHS Pension Scheme enables members to be flexible about the age at which they retire to suit their plans, allowing them to retire earlier or later with a corresponding reduction or increase to their pension benefits, where applicable. Members can choose to:

- take early retirement before their NPA, if they have reached the minimum pension age set by the scheme or section they are part of. This may result in a reduction to pension benefits as they will be paid for longer.

- retire later than their NPA and their pension benefits may increase by the application of late retirement factors. Late retirement enhancement is available to staff in the 2008 section and 2015 scheme of the NHS Pension Scheme.

Early retirement reduction buy out (ERRBO)

Members can pay additional contributions to buy out, or reduce, the actuarial reduction that would be applied to their pension were they to retire before their normal pension age. After joining the 2015 scheme, there will be a three-month window to take out an agreement with a buy-out period beginning with the member’s first day of pensionable service.

Alternatively, a member will have three months after the beginning of each subsequent scheme year to take out an agreement, with the buy-out period and contributions backdated to the beginning of that scheme year. Please note that ERRBO is different to the existing provision for early retirement in ‘the interests of efficiency for the service’.

Availability of retirement flexibilities

The following flexible retirement options are available to your staff depending on which part of the NHS Pension Scheme they have benefits in:

All retirement flexibilities are subject to discussion and agreement between the employee and the employer.

Members can find out which section or scheme they are in through their Total Reward Statement or Annual Benefit Statement.

Flexible retirement resources

To support retirement planning discussions, we have created resources for organisations to use to promote the flexibilities to staff.

Ways to retire flexibly poster

Our personas poster provides an example of each flexible retirement option and the benefits for the individual.

Persona editable Word version.

Retirement flexibilities poster

You can use our retirement flexibilities poster (PDF) to support your conversations with staff about the flexible options available in the NHS Pension Scheme.

The NHS Staff Council has published guidance for employers on the process for considering flexible retirement requests.

For an example of how to promote flexible retirement options, read our case study. In it, Dorset Healthcare discuss how they raised awareness of retirement flexibilities using educative virtual sessions.

Next steps for employers

Consider how flexible retirement plays a role in your organisation’s policies, strategy and communications to staff.

Communication

- How will you promote flexible retirement options to staff?

- How can you educate line managers about the benefits of flexible retirement?

- How do you support staff who manage individuals or teams to have retirement planning discussions with their staff?

- How do you incorporate flexible retirement and retirement planning into ongoing conversations about flexible working, development and health and wellbeing?

Strategy

- How can flexible retirement be used strategically to retain valuable experienced staff and meet workforce priorities?

- How can you build a workplace culture that embraces flexible retirement and embed it as normal practice alongside flexible working?

- How will you evaluate the impact flexible retirement has on your workforce?

Policy

- Do your existing policies include retirement flexibilities?

- How do you evaluate and manage requests for flexible retirement fairly and consistently? Have you worked with trade unions to agree a standard appeals process for all staff to use if their flexible retirement request is not agreed? See the NHS Staff Council's guidance on the process for considering flexible retirement requests for support with this.