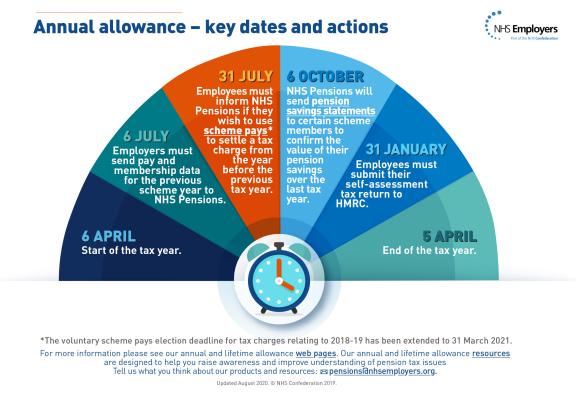

Annual allowance key dates and actions

Annual allowance is the amount of pension savings an individual can make in one year without paying tax. If an employee builds up pension savings that exceed the annual allowance, a tax charge is due on the value of the excess benefits.

Employees must take action to understand if they have incurred a tax charge and to consider the options available to them. We would encourage staff to take independent financial advice to ensure they fully understand their position and are able to make well informed choices.

This infographic can be shared with staff regularly as a reminder of the actions they may need to take, such as:

- notifying NHS Pensions of their intention to use scheme pays to settle an annual allowance tax charge

- submitting a self-assessment tax return to HMRC.

It includes links to further information about the annual allowance to help improve awareness and understanding.

Download the annual allowance key dates and actions as a PDF.